Kamata i garar u islamskom bankarstvu

Ivan Milenković

Univerzitet u Novom Sadu,

Ekonomski fakultet Subotica

Dragana Milenković

Univerzitet u Prištini, Ekonomski

fakultet Kosovska Mitrovica

KAMATA I GARAR

U ISLAMSKOM

BANKARSTVU

Prevod

obezbedili

autori

Rezime

Iako još uvek relativno nepoznato kod nas, i za sada samo „niša“ globalnog bankarskog tržišta,

islamsko bankarstvo igraće u ne tako dalekoj budućnosti značajniju ulogu. Islamske banke,

naročito u svetlu najnovijih ekonomsko-političkih dešavanja u Srbiji (Etihadova akvizicija JAT-a,

projekat

„Beograd na vodi“ itd) nisu tako daleko od bankarskog sistema Srbije, pa je nužno razumeti

osnovne zabrane islamskog bankarstva, što je tema ovog rada. Kamata i garar, što je kategorija u

islamskom bankarstvu mnogo šira, sveobuhvatnija i višeznačnija od rizika ili špekulacije, detaljno

su razmotreni.

Ključne reči

: islamsko bankarstvo, kamata, garar, rizik, špekulacija

JEL

: G20, G15, F44

Bankarstvo, 2016,

vol

. 45,

br

. 1

Primljen: 17.11.2015. Prihvaćen: 19.01.2016.

54

originalni naučni

rad

UDK 336.71::28(497.11)

005.334:336.781(497.11)

DOI:

10.5937/bankarstvo1601054M

INTEREST AND

GHARAR IN

ISLAMIC BANKING

Ivan Milenković

University of Novi Sad, Faculty

of Economics in Subotica

Dragana Milenković

University of Priština, Faculty of

Economics in Kosovska Mitrovica

Translation

provided by

the authors

Summary

Islamic banking is relatively unknown to us. Although Islamic banking is only a segment or a

"niche" of the overall banking industry and banking market, its significance is rising steadily, and it

will play an important role in the near future. Islamic banks, especially in light of the latest

economic and political developments in Serbia (Etihad’s acquisition of JAT, the project "Belgrade

Waterfront", etc.) are not so far away from the Serbian banking system, so it is necessary to

understand the basic forbidden categories in it, which is the main topic of this paper. Interest and

gharar, which is a category in Islamic banking that is much broader, more comprehensive and

more ambiguous than risk or speculation, are discussed in details.

Keywords

: Islamic banking, interest, gharar, risk, speculation

JEL

: G20, G15, F44

55

Bankarstvo, 2016,

Vol

. 45,

Issue

. 1

Received: 17.11.2015 Accepted: 19.01.2016

UDC 336.71::28(497.11)

005.334:336.781(497.11)

original scientific

paper

DOI:

10.5937/bankarstvo1601054M

Milenković I., Milenković D.

Interest and gharar in islamic

5

Bankarstvo

, 2016,

Vol

. 45,

Concept of islamic banking

The concept of Islamic banking is based

on the so-called Islamic savings where

depositors are investors. At the end of the

year, the depositor/investor receives profit as

a percentage of the invested funds in

proportion to the percentage of the bank's

profits. (In case the bank incurs a loss – the

depositor/investor will incur loss in the same

percentage). Unlike conventional banking,

which focuses primarily on the economic and

financial aspects of the transaction, i.e. profit,

Islamic banking devotes at least equal (if not

greater) importance to ethical, moral and

social dimensions within the acceptable

religious dimensions in order to achieve a

socially acceptable distribution of wealth (i.e.

equity), in the spirit of solidarity.

Righteousness and justice are embedded in

the basic principle of Islamic banking, and the

objective is to achieve equality in the society

for the benefit of the society as a whole, in the

spirit of the teachings of the Islamic religion

(as well as other monotheistic religions) by

which the achievement of more important

goals is above any tangible benefits.

In the last twenty years, and especially

since the beginning of the global financial

crisis, there has been a trend of growing

interest in Islamic banking. In order to fully

understand Islamic banking, it must be

known that it is based on Sharia (Islamic law).

Since in Islam there are some strictly

prohibited categories – there is no room

whatsoever for the activities that take place

through the system of Islamic banking and

have to do with these prohibitions.

The list of prohibited categories in Islam,

and thus in the Islamic banking system, is not

long but is very strict:

• The most widely known is the fact that

interest

is prohibited (in Arabic:

riba

),

which is explained in more detail in the

following subsection.

• Gharar

(risk or speculation) is also

forbidden. All transactions in the Islamic

banking system must be free of any hint

of uncertainty, risk and speculation, which

is the universal goal and target in Islamic

religion and philosophy – to protect the

poor from exploitation as manifestation of

justice is the main pillar of Islamic

banking and

Islam in general. The best way to achieve

this is through division of risk (gharar

is explained in more detail in one of the

subsequent subchapters).

• The third forbidden category is

gambling

(

maysar

). What is wrong with gambling?

First, gambling does not create additional

wealth. Games of chance only transfer

wealth from its (losing) owners to the

new (winning) ones. Considering the

human resources consumed in the process,

without generating new value, wealth

transfers through games of chance cannot

be considered to be efficient. They do not

serve any social purpose. The satisfaction

and thrill they provide to the players do

not justify the opportunity costs involved.

Other exonerating circumstances like the

state revenue in the form of taxes or

employment generated by casinos,

lotteries, etc. cannot be considered as

‘advantages’ until the acceptability of

gambling itself is established (Siddici,

2009, p. 5).

• Trade in particular goods

(

bay-al-inah

) is

also prohibited (e.g. pork, drugs, alcohol, as

well as activities related to pornography

and other sorts of immoral doings, etc.)

because it is among the prohibited activities

(

haram

/sin/). Everything that is not

forbidden is permitted (

halal

) and even

better if it is for the common good

(

mashallah

/also means a private good/).

Islamic law prohibits the above stated

because it can result in the accumulation of

wealth at the expense of another.

In the banks that operate according to the

principles of Islamic banking personal loans is

an absolutely unknown category, due to the

fact that the loan must have a purpose. Also,

loans are not granted in cash, hence the

possibility of one loan being misused is

virtually excluded. The simplest possible

illustration is an example from everyday

business, in which the previously mentioned

principles would look like this: if a bank that

operates on the principle of Islamic banking

borrows money – it does not pay the (passive)

interest, nor are these funds lent with the

(active) interest. Instead, the borrowed money

is invested in a particular project, and the

lenders receive a share in the project. Thus, in

addition to avoiding the payment and

collection of interest, this is a relatively

Milenković I., Milenković D.

Kamata i garar u islamskom

Bankarstvo

, 2016,

vol

. 45,

5

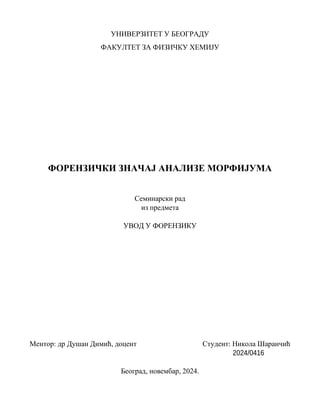

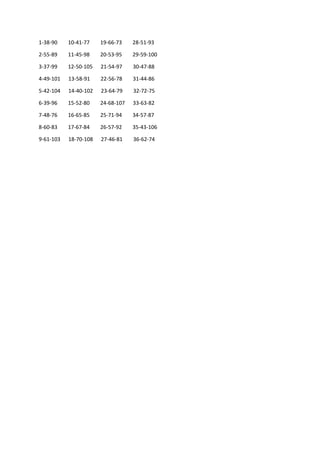

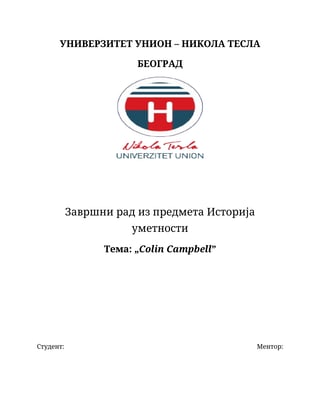

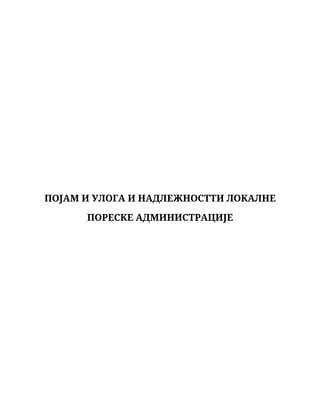

Tabela 1: Glavne razlike između konvencionalnog i islamskog bankarstva

Izvor: prilagođeno na osnovu Korten, 2010, str. 201-202

uloga novca, koji ne postoji sam zbog sebe

već da bi se olakšala i ubrzala razmena. To

je ujedno i jedna od najstarijih ekonomskih

istina, a i jedan od principa na kojima

islamsko bankarstvo principijelno istrajava.

Istaknute

karakteristike

koncepta

islamskog

bankarstva su sledeće (Ali, 2011, str. 150):

• pozajmljivanje i davanje na zajam sa

kamatom, kao i „kockarski“ oblici

transakcija, kao i neetička dobra i usluge

su zabranjene po Islamu;

• depoziti se mogu bazirati ili na

beskamatnom, ali od strane principala

zaštićenom kreditu (qard) ili na principu

podele profita i gubitka;

• finansijski inžinjering novih proizvoda

i instrumenti moraju biti u skladu sa

Šerijatom;

• dugovima se ne sme trgovati uz kamatu

niti se smeju se restruktuirati uz kamatu.

Dug, međutim, može biti zamenjen za

robu ili usluge;

• privatno vlasništvo i slobodno tržište su

osnove ekonomskog sistema.

Mnoge od specifičnosti po kojima se

koncept islamskog bankarstva razlikuje od

konvencionalnog bankarstva predstavljene su

u tabeli 1. Ono čega nema u tabeli je da kod

konvencionalnih banaka to da li će kredit biti

odobren ili ne zavisi od kreditne sposobnosti

klijenta. Za razliku od toga, kod islamskog

bankarstva se teži idealu da se finansiraju one

ekonomske transakcije koje su izgledne, a ne

da kriterijum bude kreditna sposobnost

dužnika. Osim toga, činjenica je da je

konvencionalno bankarstvo zasnovano na

sistemu delimičnih rezervi položenih na račun

kod centralne banke, što je sistem koji

omogućuje bankama da generišu izvore

finansiranja koji mnogostruko nadmašuju

potrebe za finansiranjem realne ekonomije.

Inicijalno odobreni kredit koji neretko

odobravaju konvencionalne banke, a koji

nije vezan za realnu ekonomiju može da

„izrodi“ u sledećim iteracijama nemerljiv

posledični broj kredita koji su takođe

nevezani za realnu ekonomiju. Kao rezultat

toga imamo situaciju (sadašnje stanje u svetu)

da finansijski sektor mnogostruko namašuje

realni sektor, što

Konvencionalno (kamatno) bankarstvo

Islamsko (beskamato) bankarstvo

Ono što dominantno privlači klijente

Novac

Život, kao što je Bog odredio u svim monoteističkim

religijama (Judeo-Hrišćansko-Islamskim)

Ono što definiše suštinu

Korišćenje novca da bi se stvorio novac za one i od strane

onih koji novac poseduju

Angažuje sve raspoložive resurse da bi se zadovoljile

potrebe svih, bez izuzetaka

Veličina banke

Velike (npr. mega-banke)

Male i srednje

Vlasništvo

Depersonalizovano, uz odsustvo uloge akcionara u većini

slučajeva

Personalizovano, sa važnom ulogom akcionara

Finansijski kapital

Globalni

Lokalni/nacionalni - reinvestiranje unutar granica

Svrha investiranja

Da bi se maksimirao privatni profit i blagostanje

Da bi se povećao output i blagostanje zajednice

Koordinacioni mehanizam

Centralno planiranje od strane mega-korporacija

Samoorganizovano tržište unutar mreže zajednice

Saradnja

Između konkurenata, da bi se izbegla disciplina

konkurencije, a ponekad i regulacija

Između ljudi i među zajednicom, u cilju unapređenja

opšteg dobra za sve

Svrha konkurencije

Da eliminiše nespremne sa tržišta i zauzme ga

Da stimuliše efikasnost i inovativnost

Uloga države

Da zaštiti imovinu vlasnicima

Da zaštiti interes ljudi

Trgovina

Slobodna, ali u korist mega-korporacija

Slobodna, fer i uravnotežena

Politička orijentacija

Elitistička, demokratija novca („pohlepa je dobra“)

Populistička, demokratija ljudi

Ovaj materijal je namenjen za učenje i pripremu, ne za predaju.

Slični dokumenti