Inovacije u kozmetici za muskarce

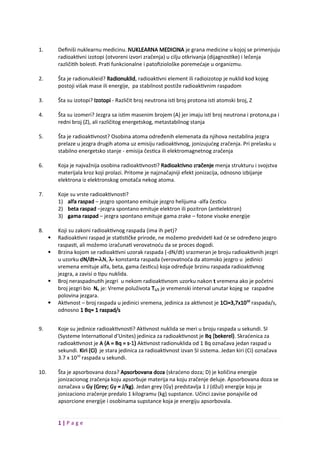

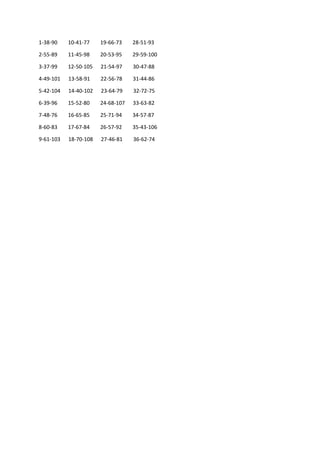

HAIR CARE SKIN CARE MEN CARE

Changing Grooming Habits Fuel

Innovation in Men’s Care

Cosmetics

Change is inevitable. Thus, the urban metro-sexual man

does not shy away from spending time and money on

grooming, which therefore brings a great opportunity to the

men’s cosmetics domain.

The global market for men’s cosmetics is set to expand at

a CAGR of 5.4 % over the next five years.

The fast-paced demand for men’s toiletries, apart from

fragrances and shaving products, indicates the growing

demand for products that cater to more than the basics.

From simple toiletries (shampoo, deodorant, shaving

cream), bathroom cabinets now have moisturizers, facial

cleansers, eye serums, bronzers, concealers, anti-aging

products, even mud masks—all designed specifically for

men.

Keeping up with the pace of dynamic market needs, a major stress has been laid on R&D for

product improvements. This caters to the changing grooming needs of men and the other strategy

has been merger & acquisitions.

The major M&As’ for male grooming products have been highlighted below:

#1. Shaving Products

This segment has been a focus of the industry for decades, stemming from the basic grooming need

associated with men and grooming habits that have changed dramatically over the past decade.

The shaving products segment has witnessed significant M&A activity, considering the varying grooming

habits of men, which range from the classic clean-shaven look to the new no-shave look. Players are

trying to cater to all the needs of consumers, but are also incurring heavy losses.

Some of the highlights are:

Emami to acquire 30% stake in Helios lifestyle Pvt Ltd (Owner of “The Man Company”) by

December’18. Following the footprints of major players in the domain, Emami plans to mark its entry

into the men’s grooming segment.

Marico acquired 45% stake in Beardo (March’17), which sells beard oil, waxes, men

soaps etc.

Anglo-Dutch consumer goods giant Unilever acquired Dollar Shave Club for USD 1

billion in cash (July’16), which implies Unilever’s footprint extending into all important

US personal care markets as well as the fast-growing men’s grooming category, which

has registered an above-industry-average growth rate. The M&A also allows the Dollar

Shave Club to expand into different geographies. The Dollar Shave Club provides a

blades-by-subscription service for as little as USD 3 a month.

P&G acquired The Art of Shaving (June’09), a premium brand of shaving kits, and also

helped the company enter into categories such as beard balms, oils, and fragrances.

Harry’s partnership with Target.com (Aug’16) marks Harry’s foray into the mass market.

Harry’s sells shaving equipment and accessories online.

Ovaj materijal je namenjen za učenje i pripremu, ne za predaju.

Slični dokumenti