The competency of economy in Bosnia and Herzegovina Pregled

Gagović, mr Željka

Brčkalo, mr Marko

2

THE COMPETENCY OF ECONOMY IN BOSNIA AND HERZEGOVINA

Summary

This paper will present an analysis of the international competitive position of Bosnia and

Herzegovina and analyze the potential impact of reform processes in BiH competitiveness.

The analysis will include a review of economic trends in BiH, with special attention put to the

movement of basic economic indicators.

Through aspect specifics and competitiveness and European integration, we shall observe the

competitive position of BiH and the reasons for such a position of BiH in international flows,

particularly through the constraints and perspectives of development of competitiveness of the

BiH economy.

Also, the presentation will show the reform and integration processes that may affect the

competitive position, and the conclusions of the analysis and recommendations for action in

the field of policy.

Keywords: competitiveness, economic trends, the economy,

JEL Classification: E5, E6, G3

INTRODUCTION

Speaking of Euro-Atlantic integration in the concept of international relations at the global

and regional level, the European Union (EU) imposes such a formal and substantial challenge

to all other regions in the world. Striving to facilitate the integration of the Western Balkans

into EU structures defining a unified strategy was achieved by implementing the Stabilization

and Association Process as a comprehensive framework intended for the process of

integration of states of this region.

The competitiveness of the economy has become the dominant economic theme in the process

of accession of Bosnia and Herzegovina's European integration. In modern conditions, the

dimensions of the competitiveness of the economy and creating attractive business

environment have greater significance. Strengthening the competitiveness of the process of

improving the business environment should enable an increase in exports, imports and the

inflow of domestic and foreign direct investment. Key indicators of competitiveness in today's

turbulent business environment are: domestic investments that are important for raising the

productivity of enterprises and infrastructure development; export which allows overcoming

barriers that determine the volume of domestic demand; imports, which provides access to

resources that cannot be produced competitively in the country; FDI inflow thus provide

additional capital, modern technology, skills and enhance the competitive pressure; outflow of

Doktorant Univerziteta za poslovne studije Banja Luka, [email protected]

foreign direct investment that fosters international growth of local enterprises; domestic

innovation that directly increases productivity.

When we look at Bosnia and Herzegovina in the international rankings and reports on the

competitiveness of the World Economic Forum (WEF) and the World Bank (WB) is located

at the back of the sheet. According to the Global Competitiveness Report WEF, BiH is ranked

139 on the menu, and its economy is on the 100th place by the general competitiveness,

according to the ranking WB, Bosnia and Herzegovina is at 125th place out of 183 ranked

economies on the ease of conducting business activities. Poor competitive position of BiH is

the result of the inefficiency of public authorities, delays in implementation of reforms and the

slow economic adjustment. BiH is not an attractive destination for foreign investors.

1. ECONOMIC TRENDS IN BIH

In this section, I'll make the review of economic trends in BiH. We analyzed the movement of

basic economic indicators such as gross domestic product (GDP), the budget, the balance of

payments and external debt, the growth of exports from Bosnia and Herzegovina, and

development of Bosnia and Herzegovina.

1.1. MOVEMENT OF BASIC ECONOMIC INDICATORS IN BiH

The economy of Bosnia and Herzegovina recorded a recovery in growth in the last 5 years,

but still has not reached the level of GDP in 1991, while data on growth (at a very low base)

should be taken with a reserve. In the period from 2004 to 2008 BiH economy grew at a real

rate of 6.5% to the estimated 10% (in 2007). In 2014 it came to fall in growth due to the

consequences of the economic crisis, but BiH in 2015 again recorded growth, even though at

a lower rate (2.3%).

Unemployment, one of the biggest social problems of Bosnia and Herzegovina, is growing

partly as a result of the global economic crisis. When reading the official data (registered

employment and unemployment) we should take into account the fact that there are a large

number of persons registered as unemployed due to the exercise of rights, but actually work in

the informal economy, and it is indicative that unemployment is rising and employment is

falling. Number of registered unemployed persons in BiH in 2016 has reached 520,000

people. Despite these facts, the net salary is constantly growing, so in 2016 the average net

salary exceeded 820 KM (420 Euro), which puts Bosnia and Herzegovina in one of the

countries with medium prices workforce. By comparison, the average salary in the countries –

newly joined to the EU member states such as Bulgaria and Romania, 220 (Bulgaria) and 340

Euro (Romania).

BiH currency is linked to the Euro at a fixed rate, so in BiH inflation is relatively low and

ranges from 1-3%. Nevertheless, BiH recorded a significant growth rate (measured by the

consumer price index CPI), which in 2008 reached 7.4%. The share of public revenue and

expenditure in GDP remains high with a tendency to increase, and Bosnia and Herzegovina in

2014 and 2015 had a deficit of 1.1% and 2.6%. It is assumed that the signing of a new

arrangement with the IMF, which is expected by the end of 2016, will bring with them a

number of conditions relating to the reduction of public spending and deficits.

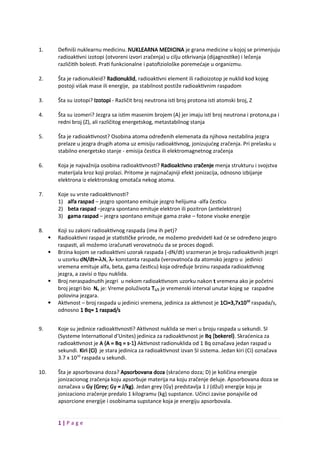

Analysis of export and import trends in the period 2005 - 2015 shows that export goods has

been increasing steadily, and this is at a much higher rate than imports, leading to a decrease

in trade deficit with other countries. Estimated external trade deficit with foreign countries in

2015 was 6.5 billion KM, which represents about 30% of GDP in BiH, and export-import

ratio reached 52%.

However, data on the growth of exports and improving the trade balance should be interpreted

taking into account several facts. According to the structure of the product, 34% of foreign

trade consists of semi-finished products and products with low added value, Non-durable

consumer goods have participation of 24%, while capital goods make up 15% and energy

18% of total trade in 2015. The product categories in which BiH surplus are: wood and wood

products, clothing and footwear, as well as various products which include furniture. BiH

surplus also trade electricity, or import enough oil and oil products, and these products fall

into the category of mineral products, which give the overall negative result.

In the structure of BiH, exports dominate by base metals and their products (22.7% of total

exports). The bulk of these categories account for aluminum and steel, which grew in total

value due to rising prices of these goods in the world market. This export product is largely

based on imports of raw materials and on the use of domestic electricity under "special

circumstances", and achieving a relatively modest total added value. Other significant export

product parts for the auto industry, which according to statistical classifications fall into the

category 'machinery and equipment' (9.8% of total exports). BiH is a significant source for

parts for the automotive industry in the EU, which in the past two years experienced a

recovery, and this is the export branch in constant growth, with relatively high added value.

The third group is export furniture (9.6% of the total). This is a branch of the expansion,

whose growth in exports (2015 compared to 2014) is 26%. The most of the exports goes to

the EU market (Germany and Italy). Next significant export category are chemical products

with 6.9% share in total exports. An important category of exports is electricity and mineral

fuels.

Table 1 – External export exchange of Bosnia and Herzegovina with major trading partners,

2015

Sources: BiH Agency for Statistics, Directorate for Economic Planning 2016

The main trading partners are neighboring countries, while Bosnia and Herzegovina with a

majority of these countries has a negative trade balance. An additional challenge is the fact

that Bosnia and Herzegovina with these partners exchanges in which mainly imports products

of high stages of processing (and value added), and exports products of low level of

processing.

1.3. DEVELOPMENT OF BOSNIA AND HERZEGOVINA

During the period of the last seven years, the development of Bosnia and Herzegovina is

conducted in coordination state and entity governments, and for coordination of strategic

planning and monitoring the implementation of policies and objectives is in charge of the

Directorate for Economic Planning. Strategic development documents for the period 2004-

2014

as well as a valid development platform

, the main development emphasis is given to

increased competitiveness of the BiH economy and promotion (and growing) of exports from

BiH. Increasing the competitiveness of the economy is in the initial development document

cites as one of the strategic objectives. The reduction of the trade deficit and the growth of

BiH exports is one of the fundamentals of economic and foreign policy of Bosnia and

Herzegovina

. One of the main tasks set before the network of diplomatic and consular

missions of Bosnia and Herzegovina is to promote BiH exports and link economic entities of

Bosnia and Herzegovina with business partners from abroad. In the analysis of obstacles for

the further growth of exports in the Foreign Trade Chamber

, as well as key areas in which

lack support of the public sector in exports say as follows:

• Institutions for the creation and implementation of development, industrial and trade

policies;

• Institutions for the promotion of activities to raise competitiveness (Competition Council of

Bosnia and Herzegovina);

• Institutions for standardization, certification and enforcement of regulations and

international obligations in the field of consumer protection, environmental, sanitary and

phytosanitary measures;

• The underdevelopment of institutions in the field of financing and support exports;

• The underdevelopment of institutions for the promotion of export opportunities and export

companies of Bosnia and Herzegovina;

• Underdevelopment institutions to provide information on export markets, competitive

market conditions and prospects for the development of export markets;

• Underdevelopment and low operational capacity network for the promotion of BiH economy

abroad (economic diplomacy);

• Underdevelopment network export mediators to intervene in the export of goods BiH

producers, especially for export (export trading company, the company management export

agents and the like.);

• Lack of institutions to support micro, small and medium sized companies in their

development and internationalizing (Agency for SMEs);

• Lack of institutions for design and marketing functions in BiH exports;

• Lack of public funds for research studies on competitiveness, industrial and commercial

strategies, capabilities of individual markets for exports from BiH finance magazine for

export from BiH;

• The lack of alternative sources of supply energy;

• High interest rates (above 10%);

• Poor Law about Foreign Investments;

The revised medium-term Development Strategy 2004-2009 with Action Plan, the Council of Ministers, 2006

BiH Development Strategy 2010-2015, the Council of Ministers, 2010

The strategic directions of development of foreign trade and export support, the Ministry of Foreign Trade and

Economic Relations, 2005

Analysis of Foreign Trade and proposed measures to reduce the foreign trade deficit of Bosnia and

Herzegovina, Foreign Trade Chamber of Bosnia and Herzegovina, 2007

Želiš da pročitaš svih 21 strana?

Prijavi se i preuzmi ceo dokument.

Slični dokumenti

Ovaj materijal je namenjen za učenje i pripremu, ne za predaju.