Making Customers Pay Pregled

MAKING CUSTOMERS PAY

165

Journal of Strategic Marketing

ISSN 0965–254X print/ISSN 1466–4488 online © 2003 Taylor & Francis Ltd

http://www.tandf.co.uk/journals

DOI: 10.1080/0965254032000133476

Making customers pay: measuring and

managing customer risk and returns

LYNETTE RYALS

Cranfield School of Management, Cranfield University, Cranfield, Bedford MK43 0AL,

UK

CRM (Customer Relationship Management) builds on the Relationship Marketing idea

that lifetime relationships with customers are more profitable than short-term transactional

relationships. However, subsequent work on the profitability of customers has shown that

some customers are very unprofitable. This leaves managers with a problem: how to

focus their relationship management efforts to maximise shareholder value. A suggested

theoretical approach is to view the customer base as an investment portfolio. This paper

uses the portfolio management model of risk and return to explore the measurement of

returns and of the risk of the customer. Some implications for CRM managers are outlined.

KEYWORDS: Customer Relationship Management (CRM); customer profitability; customer

risk; customer portfolio

INTRODUCTION

The emergence of Relationship Marketing with its emphasis on customer retention (Reichheld,

1993; Christopher

et al

., 1991) has sparked considerable interest in the relationship between

customer retention and increased profitability (e.g., Blattberg and Deighton, 1996; Reichheld,

1996; Reichheld, 1993; Reichheld and Sasser, 1990).

More recently, it has been suggested that

a company’s relationships with its customers are one of its most important assets (Srivastava

et al

.,

1998; Hunt, 1997; Kutner and Cripps, 1997; Peppers and Rogers, 1997 and 1994) and that pro-

active management of the customer relationship that leads to greater customer satisfaction can

increase the profitability of the firm as a whole (e.g., Ittner and Larcker, 1998). This has encouraged

companies to view their relationships with customers as assets in themselves (Hunt, 1997; Kutner

and Cripps, 1997) which are capable of management. More recently, it has been suggested that

one of the primary purposes of marketing is the delivery of shareholder value (Doyle, 2000)

through customer relationship management (Srivastava

et al

., 1999).

If customer relationships are assets, how do they compare with the other business assets?

Although not valued on the balance sheet, customer relationships share characteristics with

other business assets and, in particular, with brand assets. Intuitively, customer relationships and

brand relationships should have a lot in common. Both generate cash flow and profit for the

business; both are intangible and difficult to measure. These two marketing assets differ,

though, in the degree of recognition and the consequent attitude of companies to their mea-

surement. The measurement of brand assets and brand equity is considered a topic of major

importance to companies and to shareholders and has received considerable coverage (for two

JOURNAL OF STRATEGIC MARKETING 11 165–175 (SEPTEMBER 2003)

RYALS

166

examples in a large field, see Ward and Ryals, 2001 and Murphy, 1989) and it is recognised that

brands need investment.

By contrast, despite discussion of the importance of customer profitability measurement and

calls for measuring the financial impact of marketing strategies (Sheth and Sharma, 2001) and for

marketing’s central function in building customer relationships (Varadarajan and Jayachandran,

1999; Webster, 1992), most companies do not yet measure the value of their customer relationships.

Proponents of relationship marketing and of customer retention have argued that retained

customers are more profitable (Reichheld, 1993; Reichheld, 1996; Reichheld and Sasser, 1990;

Peppers and Rogers, 1995). However, more recent work has demonstrated that retained cus-

tomers are not necessarily more profitable and what matters is how customers are managed

(Reinartz and Kumar, 2000; Reinartz and Kumar, 2002; Leszinski

et al

., 1995).

As the foregoing discussion illustrates, the measurement of customer profitability is a significant

topic in its own right and is linked to the management of customer relationships (Gupta

et al

.,

2001; Rust

et al

., 2001; Zeithaml

et al

., 2001; Mulhern, 1999) and the considerable field of CRM

(Ryals

et al

., 2000). Whilst these two fields are of interest in the current context, the purpose

of this paper is to draw a further parallel between brands and customer relationships, the notion

of the portfolio. It is commonplace for marketing managers to discuss the brand portfolio and

the measurement and management of this portfolio, the impact of brand extensions on the

performance of the overall portfolio, etc. (e.g., Davidson, 1997). It is more unusual for marketing

managers to discuss their customer portfolio.

Marketing portfolio analysis

Portfolio analysis is the process of reviewing a group of investments, usually with a view to

making asset management or resource allocation decisions. In marketing, portfolio analysis has

tended to focus on product portfolios, such as the Boston Matrix. Other authors have recognised

the importance of customer attractiveness (profitability, growth, etc.) but have discussed this

largely in qualitative terms (e.g., Fiocca, 1982).

Quantitative portfolio analysis was popularised through the work of Nobel Laureate William

Sharpe in the early 1960s (Sharpe, 1964). Sharpe’s work is associated with Modern Portfolio

Theory (MPT) and with the capital Asset Pricing Model (CAPM). The work is based on share

portfolios; essentially, MPT suggests that investors will aim to maximise returns for a given level

of risk. Rational investors will demand higher returns for higher levels of risk; they will also

prefer the lower-risk of any two investments which have the same returns, and prefer the

higher return investment of any two which have the same risk. The CAPM shows how the

required return can be calculated (Brealey, 1983; Sharpe, 1981).

Although MPT has been enormously influential in financial markets, its influence in the

fields of management and marketing has been limited. The work of Larréché and Srinivasan is

an exception; they call for the application of quantitative portfolio analysis using discounted cash

flow techniques and discuss the application to business unit sales and marketing expenditure

(Larréché and Srinivasan, 1981, 1982). More recently, Dhar and Glazer (2003) have proposed

treating the customer portfolio as a share portfolio.

This paper builds on the work of Larréché and Srinivasan and Dhar and Glazer and applies

MPT to marketing. Specifically, it argues for a parallel between the measurement and management

of the customer portfolio and the measurement and management of share portfolios. In particular,

this paper will build on the current work on customer lifetime value and the customer portfolio

(e.g., Lemon

et al

., 2001) and will draw on portfolio theory to argue that the risk of the customer

RYALS

168

either as customer profitability or customer lifetime value. However, customer profitability, a

single-period measure of the returns from a customer, can be very misleading as a guide to the

total value of that relationship (Wilson, 1996). Customers may be unprofitable in one year

because of one-off factors such as the cost of acquisition (if the customer is new) or perhaps

some customer-specific factor (for example, if the customer is in temporary financial difficulties

and purchase volumes fall faster than servicing costs). Single-period measurement of customer

profitability may not be a reliable guide to the true value of that customer. A better measure

of customer returns is, therefore, customer lifetime value, defined as the stream of profits over

the course of the relationship lifetime.

Methodology

The application of MPT and the CAPM to a customer portfolio took place during a longitudinal,

collaborative research project with the customer management team of a leading insurance com-

pany (Ryals, 2002b). Throughout the project lifetime of 18 months, the application of MPT

and CAPM was carried out through researcher interventions with the Customer Delivery Team

(CDT) and auxiliary team members, as appropriate. Researcher interventions included workshops,

face-to-face interviews and the iteration of 22 spreadsheets to arrive at customer lifetime value

(returns) adjusted for risk. In total, researcher intervention occurred on 14 separate occasions.

The accuracy of quantitative data was checked in two ways. Successive versions of a

spreadsheet (Microsoft Excel) were fed back to members of the CDT and their views solicited.

This led to considerable changes in the customer revenue and cost forecasts. Other quantitative

data were checked for accuracy of calculation and transcribed by a third party who had data

entry experience.

Measuring returns from the customer portfolio

This section includes examples of customer risk and returns calculations carried out by the

customer development team (Ryals, 2002b). The first step in applying CAPM to the customer

portfolio is to measure returns from the customer portfolio by estimating the relationship lifetime

and forecast likely revenues, costs and hence customer profitability each year for the lifetime of

the relationship. Customer lifetime value has three elements: duration of relationship, revenues,

and costs. Relationship duration can be forecast by the key account manager or extrapolated

from previous experience. Revenues are a function of actual and anticipated product or service

sales. Customer-specific costs are more difficult, since most organisations are not able to identify

the precise costs of servicing their individual customers. Tracking customer-specific costs is a

live issue for CRM managers although technology can help. For example, call centre and sales

force automation systems can automatically identify time spent, customer by customer.

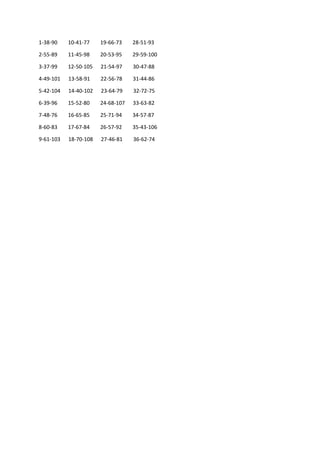

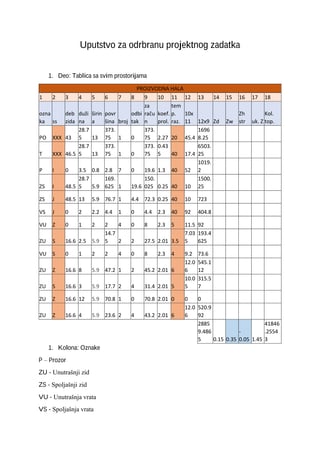

Table 1 shows the returns forecast for a major customer, a charitable foundation.

The total value of the customer portfolio, or customer equity of the firm, can be calculated

as the sum of the individual customer lifetime values (Lemon

et al

., 2001). However, MPT and the

CAPM model suggests that customer lifetime value, or customer equity, may be an inadequate

measure of the true value of the customer. Customer lifetime value and customer equity is

about a profit stream, but MPT and CAPM says that risk, as well as returns, must be taken into

account if shareholder value is to be created. When calculating the lifetime value of a relationship

with a specific customer a discount rate is usually applied to future profits to determine customer

lifetime value (see Table 1) but this discount rate does not necessarily bear any necessary relationship

Želiš da pročitaš svih 13 strana?

Prijavi se i preuzmi ceo dokument.

Slični dokumenti

Ovaj materijal je namenjen za učenje i pripremu, ne za predaju.